Welcome to the HiPipo Foundation website – an established champion of digital and financial inclusion. We are known for championing digital innovation and Instant, Inclusive Payment Systems (IIPS) across Africa under the HiPipo Include Everyone Program. We facilitate the adoption of Digital Financial Services (DFS) by advising and mobilizing relevant financial inclusion stakeholders. For example, in August 2022, HiPipo delivered the Third Season of the #40Days40FinTechs event. Organized in face-to-face locations in Uganda, Kenya, and Tanzania, the event covered topics such as Mojaloop and offered guidance on Level One Project principles. On the global scale, HiPipo is a proactive advocate for digital innovation, FinTech, and Financial Inclusion.

In addition, we delivered the 3rd Women in FinTech Hackathon & Summit, the 2nd Women in FinTech Incubator, the 9th Digital Impact Awards Africa, and the Digital & Financial Inclusion Summit. We support projects that improve low-income users’ access to DFS. We empower the underserved and unbanked, including special interest groups such as women, persons with disabilities, the youth, traders, local artisans, musicians, sportspersons, healthcare providers, and subsistence farmers.

The HiPipo Include Everyone Program enables stakeholders in the financial inclusion ecosystem to collaborate on closing the gaps in access to technology, skills, and the usage of DFS. For instance, we offer women the technical and business skills required to succeed in the DFS sector. Through this program, we identify, analyze, and promote trends and innovations in digital financial services that have a potential impact on financial inclusion in Africa. Our primary objective is to flag, advocate for, and shine a light on impactful and transformative directions in the financial inclusion arena.

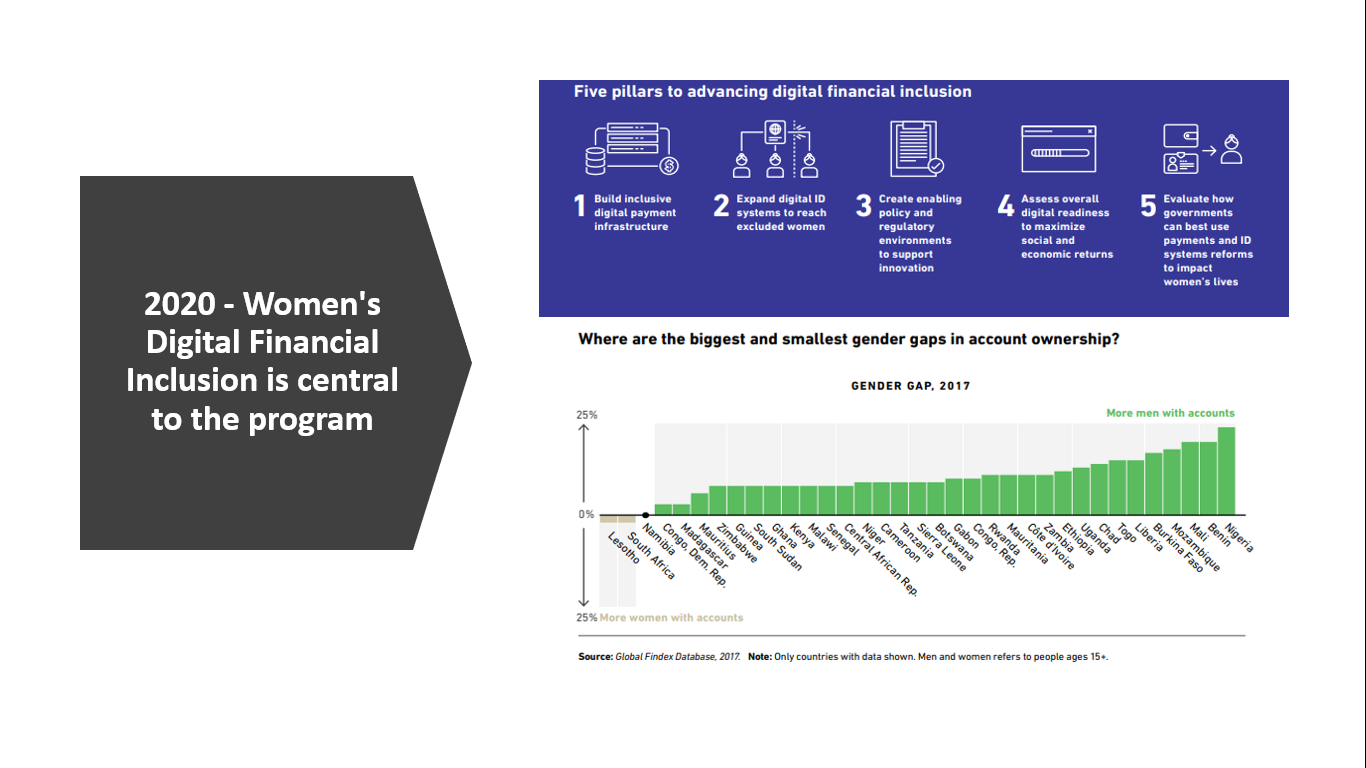

Our activities boost social transformation, ultimately enhancing the control that women and girls have over their own lives. We advocate for women’s inclusion in digital financial services as a way to boost their participation in agriculture, health, education, and leadership. As such, HiPipo empowers the next generation of women and girls. Our strategy aims to ensure that women have more access to and use of digital financial services, such as mobile money wallets, mobile bank accounts, and digital payment systems, to close the persistent gender gap in financial inclusion.

What we do

- We advocate for Digital Innovation and Financial Technology to work and to improve the lives of the poor.

- We advise ecosystem stakeholders about how to best develop DFS Systems that are Pro-Poor by carrying out impact and value assessment studies on various digital financial products and services in Africa.

- We promote making of DFS systems that are open and interoperable, offer real time clearing, use push payment model, ensure same day settlement, are KYC Tiered with shared interoperability and fraud management infrastructure/plan and systems that work with an understandable cost recovery based shared infrastructure for collaborative space.

- We help stakeholders in developing frameworks for scaling DFS in Africa, through training, organizing events such as the Digital and Financial Inclusion summits, women, refugees and youth workshops and Hackathon.

- We reach out the largest number of Digital Innovation companies and FinTechs in Africa, both global and indigenous and provide a leveled platform for them to showcase their innovations, to share knowledge, and we celebrate the most outstanding financial technology products through our annual Digital Impact Awards Africa project.

Why Include Everyone Advocacy?

The Include Everyone Program is committed to providing support for all stakeholders in the financial technology ecosystem. Our advocacy aims are multifaceted and aimed at driving financial inclusion in Africa.

Firstly, we aim to ensure that all members of society, especially the poorest, have access to the most affordable financial services. We believe that financial services are critical for individuals to escape poverty and build a better future for themselves and their families. Therefore, we advocate for policies and regulations that enable FinTech innovation and drive usage while safeguarding consumer rights.

Secondly, we conduct research to gather the views and wishes of DFS stakeholders and consumers and ensure that they are genuinely considered when policy decisions are being made. We believe that it is essential to understand the needs and wants of consumers in order to create effective policies and products that truly serve their needs.

We identify, analyze, and prioritize trends and innovations that have the capacity to transform the financial inclusion arena. We believe that staying ahead of emerging trends is critical to developing effective solutions that can drive financial inclusion.

We advocate for the stability of the DFS ecosystem growth. We believe that it is important to create an environment that supports the growth of digital financial services, as this will provide sustainable financial solutions for the poorest members of society.

We also promote the use of financial technology to serve a variety of sectors, including agricultural development, accessibility of affordable education, health services, safe water, and energy. Additionally, we seek to promote gender equality by empowering women with financial education, reliable and secure digital financial tools.

Ultimately, our goal is to see digital innovation and digital financial services stakeholders develop and provide interoperable DFS payment systems that are accessible, reliable, secure, and valuable, with a clear value proposition for the poor to use DFS rather than cash or other traditional services. We believe that affordable financial services will provide users with more value in excess of the cost of service, while also being profitable for investors in digital financial services, earning sustainable margins.

How we do it

Our organization curates a range of events including the highly-regarded 40 Days 40 FinTechs, digital financial literacy workshops, Hackathons, awards, and summits. Additionally, we conduct impact-oriented studies with a humanitarian focus, and support the development of proof-of-concept products for digital financial inclusion.

-

With whom we do it

We collaborate with global development agencies, foundations, financial institutions, regulators, governments, and various stakeholders who seek to enhance financial inclusion in Africa. Our partnerships encompass a wide range of entities, including telecom regulators, central banks, operators, banks, Women Leaders and innovators, FinTechs, developers, and consumers.

-

When we do it

We are committed to promoting financial inclusion in Africa every day of the year. At the end of January, we publish our annual program to share our progress and plans with our partners and stakeholders.

Projects

- Financial Inclusion Impact Research: Each year we pick a research topic for which we measure financial inclusion impact. Our Digital Impact Awards Africa research for Time Saving Capacity of Mobile Money was referenced in the GSMA[1] 2017 State of the Industry Report on Mobile Money.

- Digital and Financial Inclusion Summit: The yearly summit is planned to be a strategic gathering of for profit and not for profit leaders of financial inclusion, public and private sector organizations, banking and telecom operators from across Africa.

- Digital Impact Awards Africa: Our annual research-based awards project celebrates and promotes excellence in product, services and innovation for Financial Inclusion. Previous M-Pesa [2] Co-Initiators and promoters Mr. Michael Joseph, Ms Susie Lonie , Dr. Nick Hughes have given remarks at our awards events that are also attended by big brands in financial inclusion space.

- Digital and Financial Inclusion Expo: The expo aims to bring together organizations yearly to show case new developments, products, services and innovations that are aimed at promoting financial inclusion.

- Women In FinTech Initiative: Hackathon for FinTechs and developers with innovative ideas to create new, compelling financial applications and products using OPEN API, GSMA API and/or Mojaloop Technology.

- Public Challenge/Contests: The Include Everyone program public contests/challenges will reach out to key segments of community such as youth, women, farmers to participant in Financial Inclusion Challenges/Contests which will enable us get the voices, minds and views of these people about what needs to be done to better financial inclusion for them.

[1] https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/05/GSMA_2017_State_of_the_Industry_Report_on_Mobile_Money_Full_Report.pdf

[2] http://www.digital-impact-awards.com/keynotes/