STEM – science, technology, engineering and mathematics have since time immemorial been at the forefront of global transformation, with most innovations rotating around it.

But, learning science, technology, engineering and mathematics is an expensive venture, requiring lots of time and resources. With this in mind, innovators are looking for smart and better ways of democratizing STEM. Many are rolling out innovations to address these challenges.

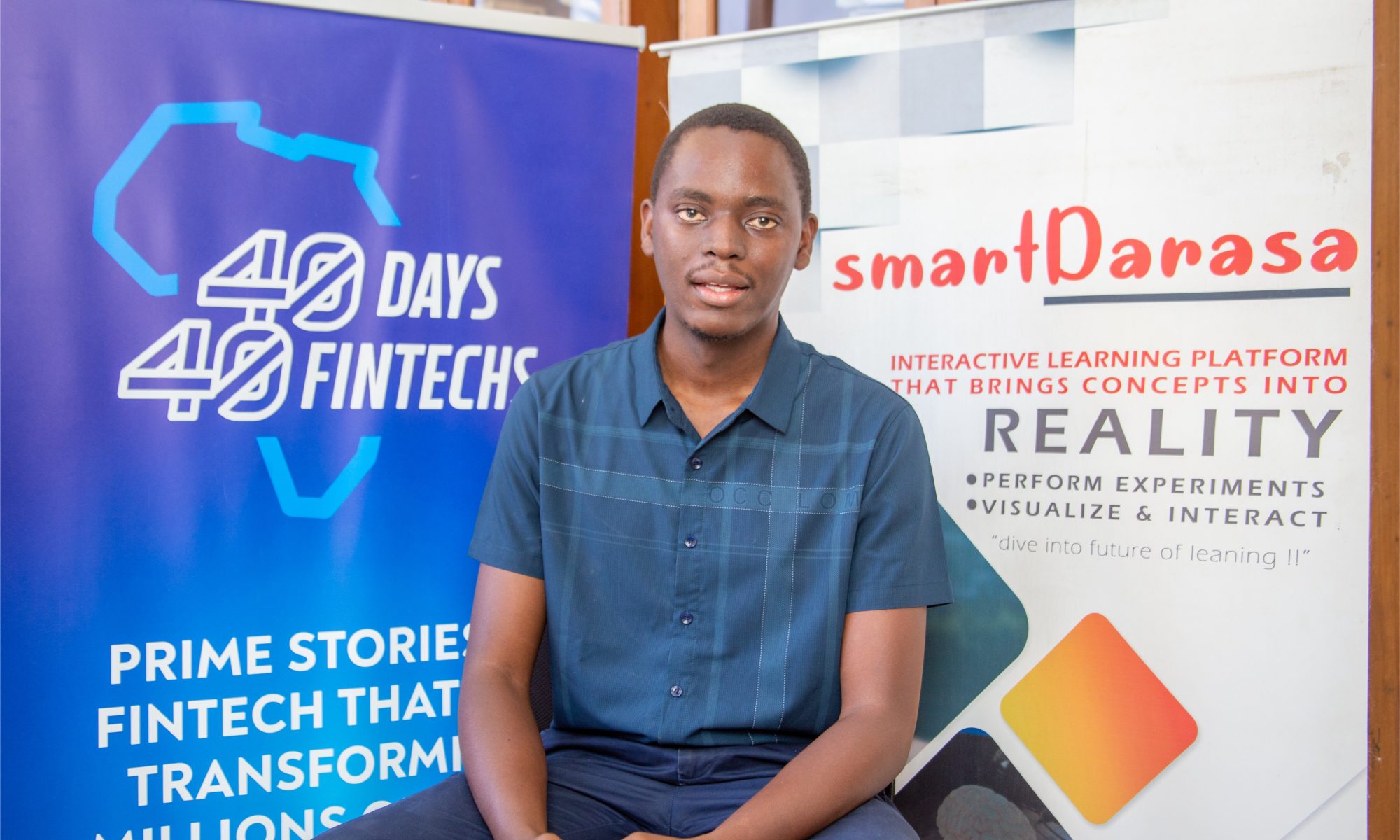

One such innovation is SmartDarasa; a digital platform with the ability to enhance normal books to make them interactive and bring content to life in the form of video, animation and 3D objects.

Founded in 2019, this platform is a next-generation learning platform helping students understand the reality and practicality of things they learn in STEM subjects.

“There is a big gap between theoretical knowledge taught in class and practical knowledge in STEM subjects which is caused by the scarcity of laboratories and insufficient laboratory tools to provide reality and practical knowledge of concepts learned in class. As a result, teachers have a hard time bridging between the theories and reality or the practicality of things they teach in class. In turn, more than 50% of students in Tanzania fail Physics, Chemistry, Biology, and Geography subjects each year, and others cram than understand. This is the problem that SmartDarasa came to solve,” Elias Elisante, the Co-Founder and CEO of SmartDarasa said.

Elisante noted that to make the platform more efficient, they introduced Smart Pay; a gamified FinTech solution that enables students to purchase digital coins off the SmartDarasa platform and utilize them on the go depending on the content they want to consume.

“We are taking advantage of digital tools such as tablets and mobile phones. The STEM content is made available on these tools and with just a digital payment, teachers and students can access this content and try out as many practical lessons as possible without breaking any laboratory apparatus,” Elisante noted.

The SmartDarasa team interacted with HiPipo on the seventeenth day of the 40 Days 40 FinTechs initiative for Tanzania. First implemented in Uganda, 40 Days 40 FinTechs is an annual FinTech Innovation initiative presented by HiPipo to recognize and celebrate individuals and organizations who are making significant strides in promoting financial inclusivity through the use of technology.

It is aimed at promoting innovation and collaboration among FinTechs in Africa. The initiative is designed to provide FinTechs and startups with mentorship, training, exposure, and networking opportunities to help them grow and scale their businesses.

Elisante noted that the 40 Days 40 FinTechs initiative is a timely intervention as it will not only attract more investors but also encourage innovators to ideate and roll out more financial inclusion solutions.

“40 Days 40 FinTechs is like a tool that seeks to understand the innovations we are implementing and the problems we are facing in rolling out these innovations. The initiative is also an advocate platform that collects our challenges and shares them with policymakers. This helps in making the ecosystem better for innovators to operate and thrive,” Elisante said.

40 Days 40 FinTechs initiative Tanzania is part of HiPipo’s broader Include EveryOne Program that is generously supported by the Gates Foundation and implemented in partnership with Level One Project, ICTC Tanzania, Ideation Corner, Cyber PLC Academy, INFITX, Crosslake Technologies, NG Films, Founders Academy and Mojaloop Foundation.

The Include EveryOne program is a beacon of acceleration of FinTech Innovation, empowerment for Women in FinTech and a catalyst for investment and development in the ICT sector. Minus 40 Days 40 FinTechs, other initiatives under the Include EveryOne Program are the FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit and Incubator, Digital Impact Awards Africa and the Digital and Financial Inclusion Summit.

HiPipo is recognized as a premier advocate of digital Innovation and financial inclusion champion, a fervent proponent of the #LevelOneProject. HiPipo has been at the forefront, actively promoting digital innovation, Instant, Inclusive Payment Systems (IIPS), and DFS across Africa. With a legacy of advising, mobilizing, and facilitating the adoption of inclusive financial services, HiPipo’s efforts have been nothing short of transformative! For almost two decades, HiPipo has successfully facilitated the inclusive adoption of these crucial services.