Our Reporter.

It is now 22 years since one of East Africa’s oldest financial technology companies, Craft Silicon launched operations.

What started as a back-end financial solutions company has since transitioned into a huge banking and financial inclusion enabler providing a wide range of solutions, from core banking, microfinance, anti-money laundering, and electronic payments among others.

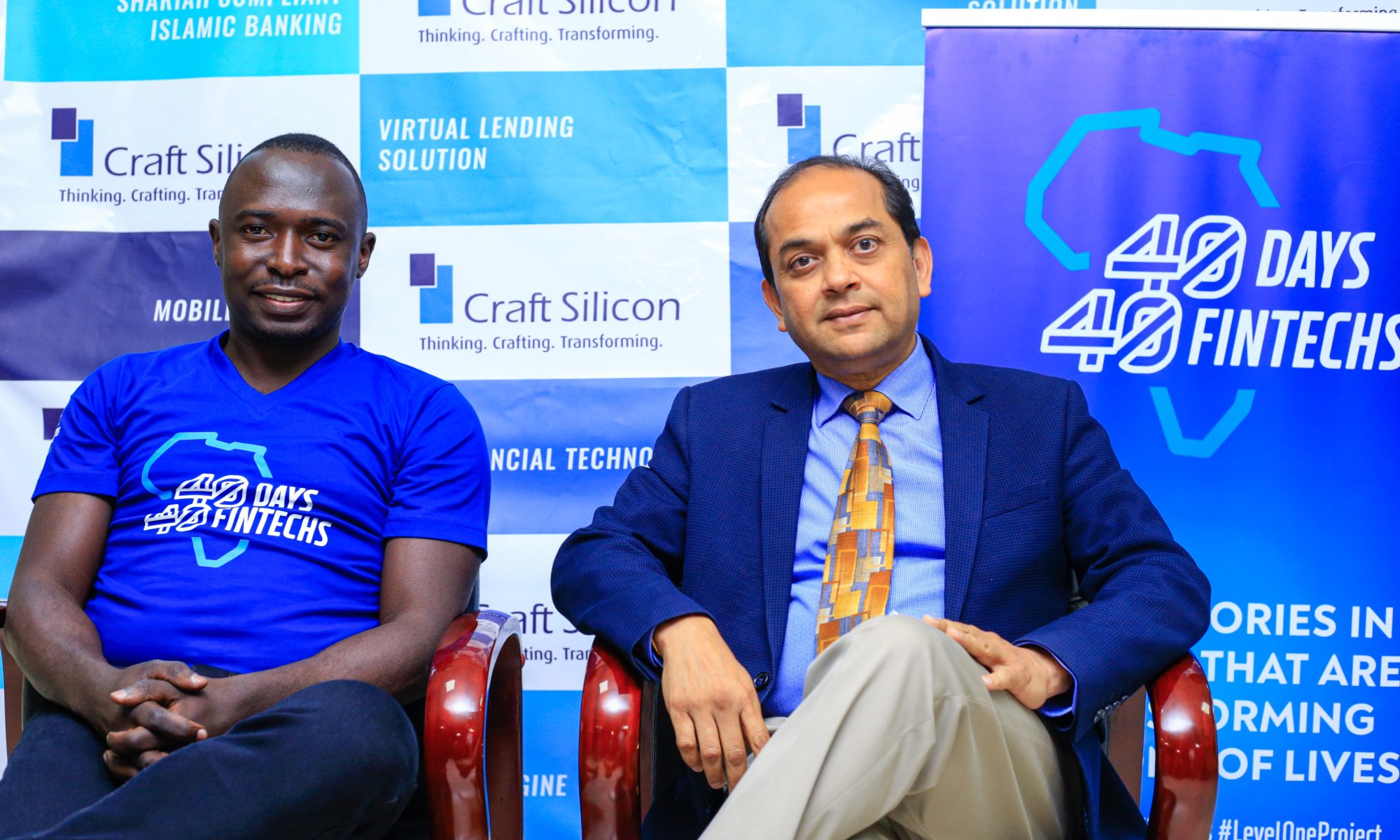

According to Vivek Bhirud, the Craft Silicon Country Head, while their primary goal was to provide backend core banking and microfinance solutions, experience over the years made them realize that financial inclusion can only be achieved if you provide the entire value chain in business transactions.

As such, Craft Silicon has since grown into a platform capable of facilitating business-to-business transactions, consumer-to-business transactions, consumer-to-government transactions, and consumer-to-consumer transactions.

To make this happen, Bhirud says, Craft Silicon provides solutions right from core banking to mobile banking, internet banking, agency banking, and even ATM services to their clientele of more than one billion people across 35 countries.

“Using our solutions such as mobile banking used by several banks, we are processing about 1 billion transactions per day. This includes the mobile money transactions and bill payments,” he says.

In order to meet the company’s aspirations of enabling last mile financial inclusion, Craft Silicon predominantly prioritizes tackling the underserved segments dominated by SMEs and MSMEs, especially those run by women and youths, to level their playing field with bigger players.

State of FinTech in East Africa.

Meanwhile, Dhimant Shah, the Craft Silicon CEO notes that Financial Technology (FinTech) is fast growing in East Africa with Kenya leading the East African Community in adoption and progress in digital financial products ‘because most of its citizens are open to embracing new technology’.

He adds that the outbreak of Covid-19 further opened frontiers for innovation in Kenya’s digital financial services sector.

“Even though we have made progress, opportunities are still immense. We will continue to expand [beyond borders]. In Uganda for instance, we are partnering with different institutions to provide instant and affordable digital loans,” Shah says.

Craft Silicon is the 41st participant in season three of the 40 Days 40 FinTechs Initiative that is shining a light on emerging and established FinTechs across the East African region.

Shah says the initiative couldn’t have come at a better time when start-up FinTechs need a lot of inspiring and mentoring.

He notes that with such interactions as 40 Days 40 FinTechs, mature FinTechs get the opportunity to share their stories, which in turn helps to inspire the start-ups and also creates room for cooperation.

“In this digital era, no one is too big and no one is too small. It is the idea that counts. I think this initiative brings visibility for the smaller players which helps in creating better solutions and collaborations,” Shah says, stressing the importance of governments, venture capitalists and incubation hubs such as HiPipo and others in fostering financial inclusion and digital growth.

40 Days 40 FinTechs.

Now in its 3rd season, the 40 Days 40 FinTech initiative is organized by HiPipo in partnership with Level One Project, Mojaloop, and Crosslake Tech and supported by the Gates Foundation.

This year’s edition is cementing the achievements of the first two seasons by looking at more impactful FinTechs from all over the East African region. The countries covered so far are Uganda, Kenya, and Tanzania.

Innocent Kawooya, the HiPipo CEO noted that FinTech giants like Craft Silicon offer a variety of learning options for young FinTech players.

“With a presence in over 35 countries, every emerging FinTech should be trying to learn how Craft Silicon has done it. We are happy that they have agreed to share their story,” Kawooya said.

Minus shining a light on impactful FinTechs, the 40 Days 40 FinTechs initiative also offers participants useful tools and an introduction to the industry’s emerging technologies, such as Mojaloop Open Source Software, and guidance from Level One Project foundational material. The skills gained from this initiative cover Level One Project Principles, Instant and Inclusive Payment Systems (IIPS), Inclusive Finance and Financial Inclusion in general.