Kampala, October 05, 2021: The #WomenInFinTech #LevelOneProject Hackathon has started today, Friday 8th October with 17 shortlisted teams and over 70 participants altogether.

Speaking during the official opening of the Hackathon, Innocent Kawooya, the HiPipo Chief Executive Officer thanked the participants for showing tremendous interest in technology, noting that the Women in the FinTech Hackathon comes at an opportune time when financial technology is playing a key role in economic transformation locally and globally.

“We are happy that this is happening today. We take pride in leading the way in helping Ugandans navigate the new tide driven by financial technology. The next 7 days are going to be exciting for all the participants as a lot will be learnt and accomplished. But even more exciting is the fact that the participants have the ability to use this platform to initiate, develop and churn out impactful financial inclusion products and services that will transform their lives and their communities. The future is now,” Innocent Kawooya said.

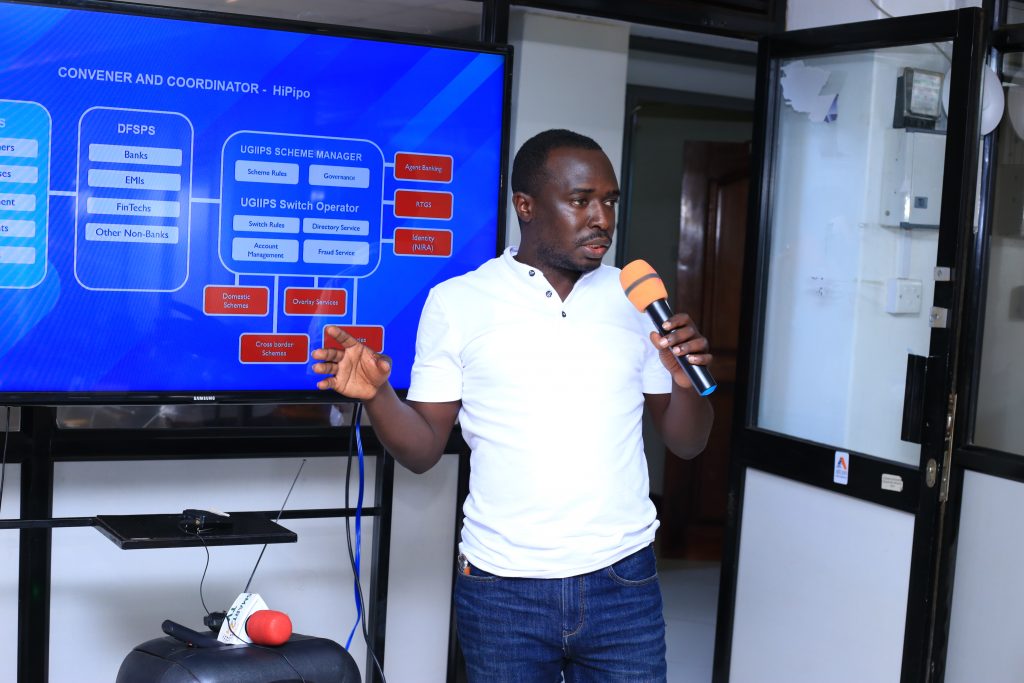

Cleopatra Kanyunyuzi – the Club Tangaza co-founder and Simon Peter Kamya – a Ugandan developer are the local facilitators at the Hackathon, supported by FinTech experts who are facilitating virtually from Europe, Asia and North America.

Day One saw all participating teams present both their Problem Statement and Business Cases. Participants also had an introductory session to both Mojaloop Open Source Software and Level One Project Principles.

The week-long Hackathon, organized by HiPipo in partnership with Crosslake Technologies, Modusbox, Mojaloop and Level One Project, will culminate into the Women in FinTech summit on Friday, October 15th, 2021 where the three top teams will be announced and share USD5,000 in prizes in addition to being part of a 90 days Business Incubator Program.

Participants are expected to come up with financial inclusion solutions that address their community needs, aided by Level One Project principles and latest technologies. All the shortlisted teams are women-led, with 2 to 4 members, and each team having at-least 75 percent female composition.

Empowering Innovators

HiPipo is proud to remain one of the continent’s premier advocates for the creation, dissemination and adoption of digital financial services, and we remain highly enthusiastic to provide the ways and means for our innovators to fully develop solutions that will collectively lead millions of our people to better lives and improved livelihoods.

The inaugural Women in FinTech initiative in 2020 exceeded expectations and left no doubt that women are ready to play a starring role in the digital financial services space and can fill the product gap the sector currently contends with.

All the 15 participating teams in 2020 presented excellent ideas, and HiPipo is more than pleased to reveal that it supported three (3) of them to grow into start-ups, each with a Minimum Viable Product (MVP) that’s ready for the market, which was a success to an extent that they went on to take part in the recently-concluded 40 Days 40 FinTechs initiative.

Ends.