Teams from Uganda and Kenya, each comprising enthusiastic individuals with diverse backgrounds and skill sets, are currently in Kampala, diligently working to refine their pitched ideas into Financial Technology solutions.

As these teams gathered on Day three, a palpable sense of anticipation filled the air with the participants waiting to listen to words of wisdom and encouragement prepared by Damali Ssali, the founder of the Ideation Corner and also, the chief programs and projects officer at Private Sector Foundation Uganda.

In her morning presentation, Ssali emphasized the power of collaboration and the potential of innovation to reshape communities. She spoke about how HiPipo itself had been built on the spirit of innovation, with its history steeped in groundbreaking ideas that had transcended barriers and transformed challenges into opportunities.

“You always have to test your idea and then you roll it out. Find friends who believe in your ideas. Sometimes you may first need to develop your idea before you start talking about it. Don’t talk to people who will tell you it will never work,” she advised the youthful entrepreneurs.

“You also need to be passionate about your idea and push it. You must believe in it first before others do. Those are the most critical steps because many ideas have died in people’s heads.”

“You have to be patient with your idea because they usually don’t materialize immediately. HiPipo has for example been in business for more than 15 years. It takes time. You must have the tenacity to continue every year chasing that dream that you have. You also have to have the flexibility of mind to adapt to the idea. The more you learn, the more you will have the flexibility to tweak your ideas,” Damali Ssali explained.

Throughout the third day of this Hackathon, the diversity of ideas among the teams was astounding – from solutions aiming to connect housemaids to customers to savings and credit solutions targeting farmers and small businesses. There are also solutions focused on providing car owners with reliable mechanics during emergencies, and others reimagining Uganda’s modes of payments.

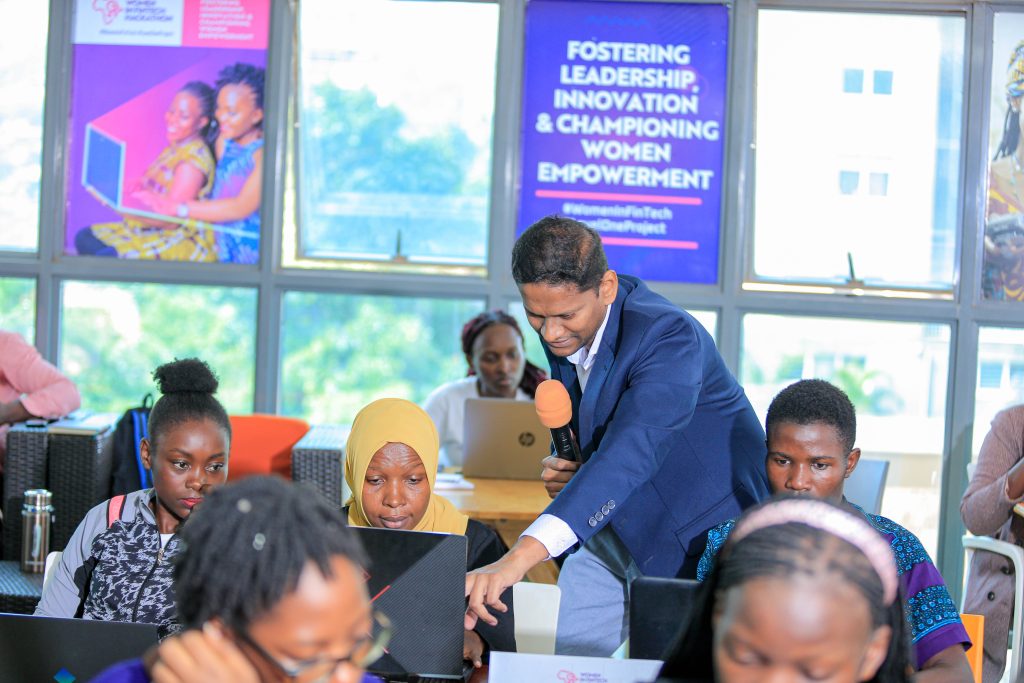

Throughout Day three, the facilitators listened attentively, their faces reflecting a range of emotions – intrigue, curiosity, and admiration. After listening to the team’s presentations, they provided insightful feedback, pushing the teams to delve deeper into their concepts, challenging assumptions, and encouraging them to consider the broader implications of their innovations.

“You don’t just wake up one day and put an idea on the market. You should consider the time span and the costs involved. If you plan adequately, you will make sure you work within the stated timelines. Look at the function requirements of the idea and find out what you really need,” Simon Peter Kamya, a Ugandan developer and one of the facilitators noted.

Collaborations also continued to blossom among the teams as they realized that their solutions often intersected, reinforcing the belief that collective efforts could lead to even more impactful results.

Paul Baker, the Principle Product Manager at INFITX highlighted that trust is of paramount importance while developing payment solutions.

“Trust builds user confidence. We need to build up a trusted relationship,” he said.

The afternoon mentor, Marion Kirabo – a legal associate at Matrix Advocates took the participants through Business Registration, Intellectual Property and Regulations.

She emphasized the need for Innovators and Tech Start-Ups, in general, to pay close attention to the latest legal developments in the industry such as the National Payment Systems Act, 2020.

Running for the 4th consecutive year, the Women in FinTech Hackathon is not just a competition; it is a platform for sharing and learning, a crucible of ideas that have unlimited potential to transform lives.

This Hackathon is part of the broader Women in Fintech initiative that also includes a Summit and Incubator program; all implemented by HiPipo in partnership with Level One Project, Mojaloop Foundation, INFITX, Cyberplc Academy, Crosslake Technologies and Ideation Corner and supported by the Bill and Melinda Gates Foundation.

The 2023 Women in FinTech Hackathon will culminate in the Women in FinTech summit on 18th August 2023 where the best-performing teams and individuals will be announced and receive their share of the USD 10,000 collective prize money. This will be in addition to the winners automatically qualifying for the Women in FinTech Incubator program that will run from September until December 2023.