Searching and finding a house to rent as a home or a business is a huge hustle involving several brokers and agents. But when you are fortunate to find your preferred house, another issue comes in.

The majority of the property owners and managers have rent agreements that guarantee them bulk payments that are yearly, half year or if you are very lucky quarterly. This requires huge amounts of cash that many people struggle to have at once.

It is such ills that Pango Africa came to cure. Pango is a home financing digital platform for Africans that helps aspiring homeowners or renters pay for their homes in convenient and flexible ways.

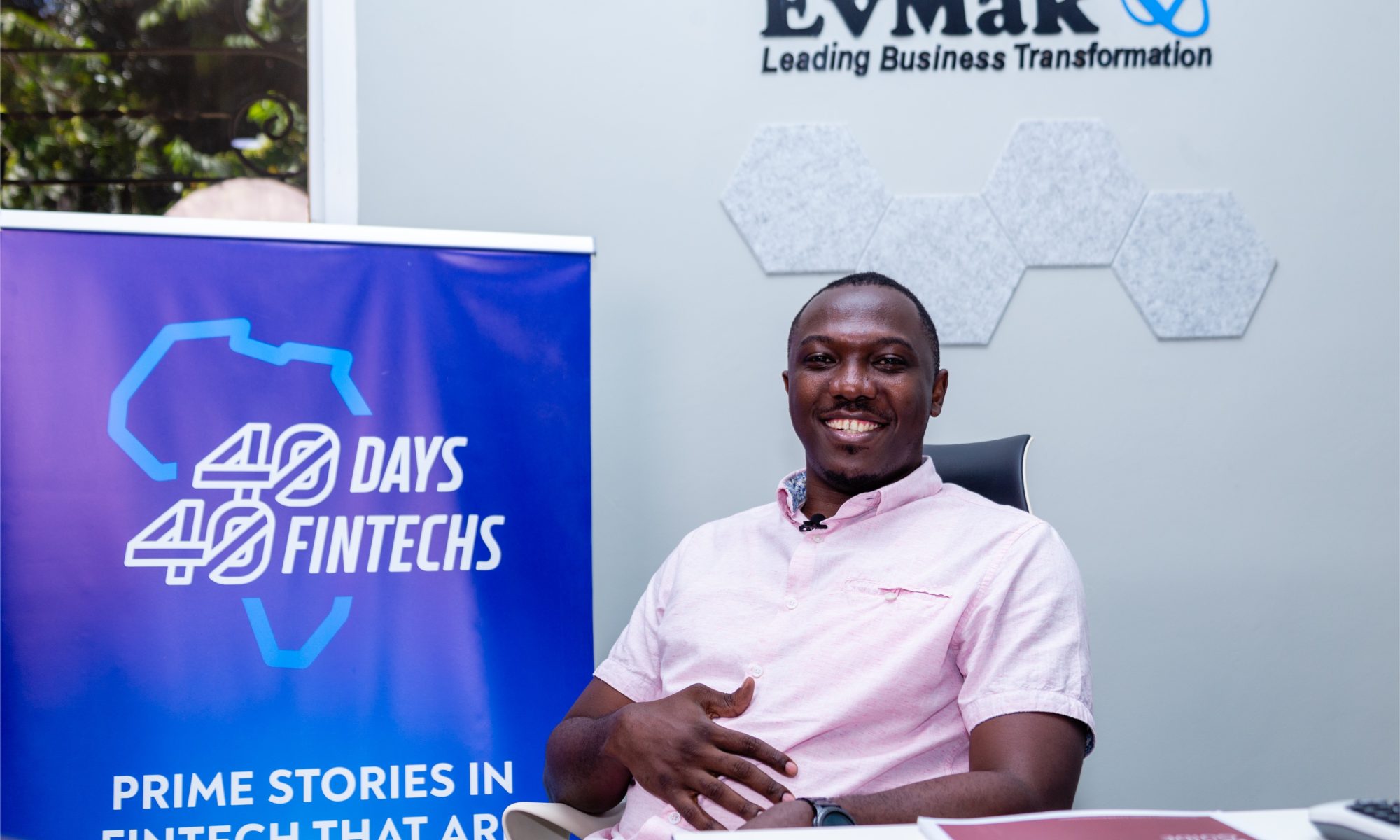

James Albany, the company founder notes that Pango is a FinTech that is implementing the program of Rent Now and Pay Later for salaried employees in Tanzania.

“Most of the landlords in Tanzania prefer three months, six months or one-year rent advances. This makes it hard for people to get affordable houses. What Pango does is pay for you for a full year, then make monthly deductions off your salary. We don’t send you the money, we send it to the landlords directly because we have realized that when people get money directly, they sometimes use it for reasons other than those they mentioned when accessing the credit,” Albany said.

He added that due to public demand, they have added a school fees payment element that is very beneficial to parents, pupils and the schools.

“We are also implementing a similar model for schools where we pay school fees directly to the schools for parents that are not able to pay the school fees on time. After making the payment to the school, we let the parents pay monthly instalments to us without worrying about their kids missing school. This we call Study Now and Pay Later.”

According to Albany, some of the main challenges they are facing while implementing this business model are growing numbers of defaulters, limited data about creditworthiness, bad employer-employee contracts and trouble signing partnerships with other Financial institutions because of the absence of collateral that Banks need to recapitalize such businesses.

“This is a new business model and thus most people don’t appreciate it. Most of these government institutions and banks don’t want to go down this route because to them it is a very risky loan business, but to us, it is where we shine.”

Pango features on Day 8 of the 40 Days 40 FinTechs initiative for Tanzania. First implemented in Uganda, 40 Days 40 FinTechs is an annual FinTech Innovation initiative presented by HiPipo to recognize and celebrate individuals and organizations who are making significant strides in promoting financial inclusivity through the use of technology.

It is aimed at promoting innovation and collaboration among FinTechs in Africa. The initiative is designed to provide FinTechs and startups with mentorship, training, exposure, and networking opportunities to help them grow and scale their businesses.

“Initiatives like 40 Days 40 FinTechs are very important as they shine a light on founders; what they are doing, their solutions and what they inspire to achieve with their innovations. This helps in market expansion and learning from one another. When you follow an initiative like this one, you will know what other innovators are doing in other parts of Africa and learn from one another. Thanks to such an initiative, investors will put their eyes on this and see what is going on in Tanzania and decide where they can invest,” Albany concluded.

40 Days 40 FinTechs initiative Tanzania is part of HiPipo’s broader Include EveryOne Program that is generously supported by the Gates Foundation and implemented in partnership with Level One Project, ICTC Tanzania, Ideation Corner, Cyber PLC Academy, INFITX, NG Films, Founders Academy and Mojaloop Foundation.

The Include EveryOne program is a beacon of acceleration of FinTech Innovation, empowerment for Women in FinTech and a catalyst for investment and development in the ICT sector. Minus 40 Days 40 FinTechs, other initiatives under the Include EveryOne Program are the FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit and Incubator, Digital Impact Awards Africa and the Digital and Financial Inclusion Summit.

HiPipo is recognized as a premier advocate of digital Innovation and financial inclusion champion, a fervent proponent of the #LevelOneProject. HiPipo has been at the forefront, actively promoting digital innovation, Instant, Inclusive Payment Systems (IIPS), and DFS across Africa. With a legacy of advising, mobilizing, and facilitating the adoption of inclusive financial services, HiPipo’s efforts have been nothing short of transformative! For almost two decades, HiPipo has successfully facilitated the inclusive adoption of these crucial services.