Our Reporter.

Financial Technology stakeholders have witnessed a lot of positives in 2020 even amidst the COVID-19 pandemic and its unprecedented effects on people and economies globally. But that doesn’t remove the fact that this has been a rough and tough year.

The highlight of the year saw world leaders imploring their citizens to embrace digital financial services (DFS) and other electronic services as means of curbing the spread of the dreaded novel corona virus.

In Uganda, the uptake of digital financial services, e-commerce, e-agriculture, e-education and e-health among others has been remarkable this year with more people adjusting to what is now the new normal.

The cardinal role that fintechs are playing in the new normal was acknowledged at the 2020 Digital and Financial Inclusion summit featuring the Digital Impact Awards Africa.

Prof. Maggie Kigozi, a Ugandan Business Leader and the event guest of honour underscored the economy saving role that the Financial Technology industry has played during these unprecedented Covid-19 times, existing challenges notwithstanding.

“I want to appreciate the young generation for seeing opportunities, jumping up to them and delivering products and solutions that we all use. I urge the Financial Technology Ecosystem players to continue working together to address any challenges. There are still a few problems here and there. But Financial Inclusion is happening,” Prof. Maggie Kigozi said.

But then the issue of access to devices and internet continues to obstruct digital and financial inclusion. To this, UNCDF’s digital country lead, Chris Lukolyo urged innovators to develop products that directly target the last mile users as this will in turn force the big players to pay more attention to addressing the devices and internet access challenges.

“The people being left out are mostly rural, immigrants and refugee communities. At UNCDF, we have piloted something called the Digital Community Entrepreneur where we are leveraging the people in the community to reach out to the doorstep, the last mile audience with digital related products and services. There are also locally manufactured devices now. It is a step in the right direction and can help to reduce the costs of devices,” Lukolyo said, adding;

“Indeed Internet access is still very expensive especially here. A lot of work still needs to be done to address this. Part of UNCDF’s strategy of not leaving anyone behind in the digital era is to foster inclusive innovation. If you can innovate with underserved communities in mind, you can come up with those viable business models that will attract the big service providers such as MTN to get down there and reduce access costs because there is money to be made.”

The digital and financial inclusion summit which was a culmination of the 2020 Include EveryOne Program was organized by HiPipo, in partnership with ModusBox, Mojaloop Foundation, Level One Project and United Nations Capital Development Fund (UNCDF).

In her keynote address, Damali Ssali, a Ugandan senior chartered accountant and trade development expert recommended that for Africa to achieve full Digital and Financial Inclusion, it must fix the regulatory framework, adopt interoperability and push for digitalization of government services.

“Digital and Financial Technology regulations should be reviewed and enhanced so that they facilitate rather than curtail financial inclusion. Providers of digital financial services should develop solutions that are interoperable and meet Level One Project Principles such as tiered KYC, and affordable devices,” Damali Ssali noted, adding;

“In any country, government is the largest provider of financial services. Governments need to embrace digital technology in the provision of public goods and services to all people. This will catalyse and speed up the rate at which financial inclusion is attained. Governments must develop infrastructure backbone to digitize the provision of financial services in a manner that is inclusive.”

Inclusive Panel Discussions.

The summit had five gender balanced panel discussions that decoded the facts and myths about digital and financial inclusion in Uganda and Africa at large. Altogether, there were 22 Panelists including 11 women.

“The gender diversity challenge in the Financial Technology industry is well documented. Mere talking about it is not a solution. Instead, we must make sure that both genders are well represented at every level if we are to achieve last mile digital and financial inclusion,” Innocent Kawooya, the HiPipo CEO said, adding;

“It is not by mistake that 50 per cent of our 22 panelists today are women. It is also not by mistake that both our keynote speaker and guest of honour are women. We are deliberately engaging more women because we know that even though they are the majority gender, they are least included. HiPipo is playing its part in addressing the gender issue. You too play your part. We thank all our partners – UNCDF, ModusBox, Mojaloop Foundation and Level One Project for contributing to the success of this summit and other activities we have undertaken in 2020.”

The first panel was themed Financial Inclusion for Women – How do we minimize and recover from Covid Impact on Women? It had Barbra Kahunde – Project Manager Pebuu Africa, Lyn Tukei – Head of Marketing and Communications at Xente, Mbabazi Suzan – Engineer and Kameeza Team Leader and Yvonne Mpanga – Business Development Consultant.

“Digitalization is a must for our recovery from the impact of COVID-19 on trade and business. Most women love technology and will surely adopt it if well guided and sensitized. But the most important thing for me is ensuring that we are healthy because COVID-19 is still here,” Yvonne Mpanga noted.

The second panel was Securing the Fintech Ecosystem – How do we effectively collaborate? The discussants were Jane Mugenyi – Head of Strategic Partnerships and Corporate Sales at the MFS section of MTN Uganda, Ronald Azairwe – Managing Director of Pegasus Technologies, Paul Tamale – Manager Card and Acquiring at Stanbic Bank and Nathan Levi Dragudi Ocatre–Implementation Manager, Transaction Banking at Standard Chartered.

This panel came at the back of a ‘mobile money fraud’ that affected Pegasus Technologies, Stanbic Bank, MTN Uganda and Airtel Uganda around September and October 2020. Different discussants weighed in on how to safeguard the industry from such incidences now and in the future.

“There was a money heist like you have called it. But what I can assure you is that the customer wallets were not affected. No customer lost any money. Being a technology platform, we have continuous controls in place using both internal and external auditors to ensure that this does not happen again. We need to use digital identity as a platform in order to reduce such cases. If we have a digital identity of somebody who performed a suspicious transaction in MTN, then we could share with Stanbic, Stan Chart and Airtel etc so that when this same person goes to perform transactions elsewhere, s/he is already blacklisted,” MTN Uganda’s Jane Mugenyi said.

Pegasus managing director Ronald Azairwe added; “The most important thing is having digital identity. There must be a rigorous process of identifying every individual and relating every transaction to an individual. Yes, it is a bit of an intrusive process but there is nothing we can do to avoid that. We need to reach a point where everything digital is linked to your NIRA National ID.”

Then came the third panel – Building the Rails: Interoperability with Private Sector Led Real-time Payments Switch: How do we achieve it? The Panelists were Peter Kakoma – Kanzu Code CEO, John Mark Ssebunnya – FinTech Platforms Architect at MTN Group, Doreen Lukandwa – Beyonic Director Marketing and Customer Success, Paul Tamale – Stanbic Manager Card and Acquiring and Nathan Levi Dragudi Ocatre– Standard Chartered Implementation Manager, Transaction Banking.

This was a special one as it envisioned financial inclusion powered by interoperability, collaboration and competition.

“There is a framework that can help all industry players understand where we can compete and where we can collaborate in real time payment systems. The framework has what we call the rails which in this case are the infrastructure. It also has the rules. We can always collaborate on the rails and the rules. Then we can be left to compete on the accounts and applications. All players must be aware that both collaboration and competition can co-exist,” MTN Group’s John Mark Ssebunnya noted.

The fourth panel addressed the 2020 National Payments Act that is currently under review with both players and the regulator working on ensuring that the law doesn’t lock out anyone but instead develops the industry without prejudice to players – big or small.

This panel discussion had Financial Technology Service Providers Association (FITSPA) Company Secretary also Bowmans lawyer – Brian Kalule, Mallan Group CEO – Malcolm Kastiro, YOTV Channels CEO – Aggrey Mugisha and Beyonic Director Marketing and Customer Success – Doreen Lukandwa.

Beyonic’s Doreen Lukandwa summed up the National Payment ACT by noting that “this regulation has come with a lot of positives, credibility, control and trying to make the ground levelled for all players involved in this particular space. It is going to be very important for the regulator to engage all the stakeholders in this space on a regular basis not just once a year but monthly and ensuring that this regulation is suited for Uganda and serves Ugandans.”

Come in Informal Traders.

After these four panels, it was clear that all the key issues touching on the Fintech industry had been competently discussed and recommendations made.

But then came the Financial Inclusion for Women Informal Traders panel discussion – a super climax that the Digital and Financial inclusion summit needed.

During this panel, Women Traders from across Kampala City asked Financial Technology Stakeholders, and E-commerce players to focus on both Real Time payments and Traders’ Training as these two are the main impediments to online transactions embrace.

The Women Traders drawn from Bugolobi, Wandegeya, Kalerwe, Mpererwe and Kitintale Markets noted that even though online transactions have saved businesses and lives during these unprecedented Covid-19 times, failure by Financial Technology players to do Real Time payments, Limited Training and Lack of latest Online Trade tools have slowed further uptake.

“There hasn’t been huge embrace of the online and technology based business in Kitintale market. We haven’t had sufficient training on online trade. We also don’t have the right tools of trade. This explains the low uptake among vendors in our market,” Nakaketo Samalie Nkata, a Women Traders’ Leader from Kitintale Market said.

Grace Akiiki, the Chairperson of Wandegeya Market Women Traders candidly noted; “We had embraced e-commerce in Wandegeya market. But we got a huge challenge of delayed and sometimes no payments from an E-commerce player we were working with. When someone orders online, they order for goods that you don’t even have on your stall. So you have to use your cash to purchase the missing items and prepare this order with hope that you will be paid immediately. But then the payment delays or never comes.”

The issues shared by these traders made up much of the discussions at this event with different speakers acknowledging the need for the industry players to implement Financial Inclusion best practices such as same day settlements, tiered KYC, Low Cost User Devices and real time funds transfer.

Damali Ssali, pleaded with Financial Technology and E-Commerce players to walk the digital and financial inclusion talk by ensuring that they train traders and also make payments for sold goods in real time.

“It is unfair that an informal trader in Kalerwe market has to offer credit to big e-commerce and FinTech players then wait for days before a payment is made. The Financial Technology industry must embrace the Level One Project principle of same day settlement. Payments for goods sold must be instantly remitted to seller through mobile money or bank,” Damali Ssali said, adding;

“Again, the FinTechs and E-commerce players must take lead on educating the traders on how this industry works. If well trained and empowered, more traders will make informed decisions and embrace online transactions.”

Additionally, in his presentation titled The Inclusive Digital Economy, Steve Haley, the Director Economic Development at ModusBox emphasized that excluding millions of people from digital financial services not only hurts business owners but also stifles economic growth.

“Small business owners don’t have any option to wait days for their money to settle in to their accounts. Their lives and businesses depend on day to day income. As such they need interoperable real-time solutions. Interoperability will enable the innovation needed to make digital payments inclusive and affordable while pouring money in to the transaction economy and supercharging the ecosystem. All we need is a single real-time payment network solution, and that is Mojaloop.”

#DIAA2020

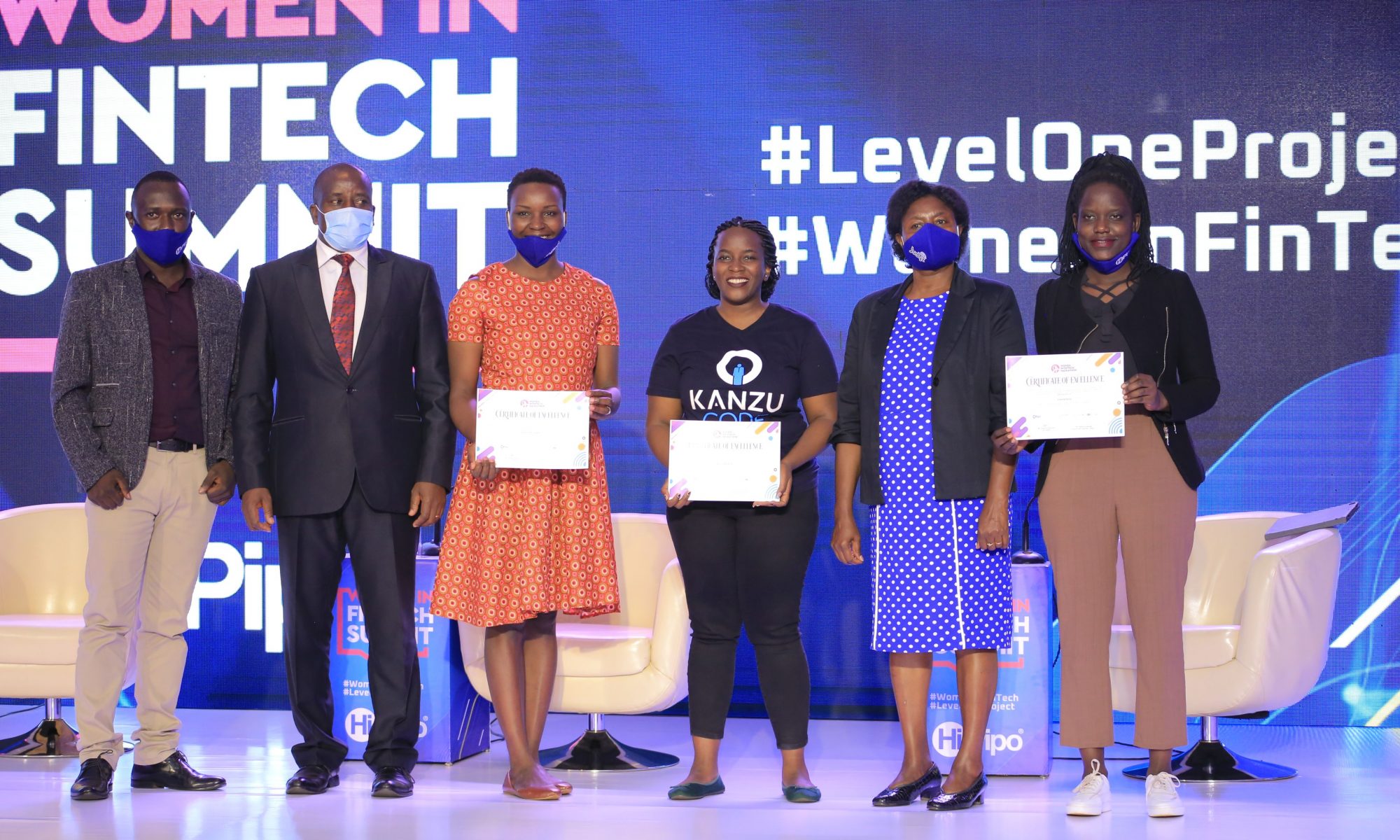

The Awards were a culmination of the Digital and Financial Inclusion Summit organized by HiPipo in partnership with ModusBox, Level One Project, Mojaloop Foundation and UNCDF.

The Digital Impact Awards Africa seeks to recognize, celebrate and appreciate different individuals and organizations that are spearheading the use of digital mediums to better serve their communities. Winners are those with the highest score from a combined Jury and Public voting process.

The 2020 winners included Standard Chartered for Digital Brand of the Year Award, Stanbic Bank took the Cards Payments Excellence Award, Jumia won E-Commerce Innovation Excellence, Centenary Bank won the Community Bank Excellence Award while Jumia was voted as Best Consumer Goods Brand on Social Media.

The special recognition for Regulatory Financial Inclusion Rails Award went to Bank of Tanzania (BoT) for their implementation of the Tanzania Instant Payment System (TIPS) while Doreen Lukandwa to the Women in Fintech Leadership Award.

Here is the full list of the 2020 Digital Impact Awards Africa winners.