By Innocent Kawooya, NIM

In December 2019, I sat on a panel at FinTech Connect in London, hosted by the Gates Foundation and moderated by Kosta Peric. I thank Miller Abel for inviting me. That day, I made a statement that still holds today: “Even if the works of the Level One Project and initiatives like Mojaloop were to fail, their championship in independently leading the conversations of interoperability would remain the king of accelerating financial inclusion. Interoperability is the main rail.” When I look back in time, it was not a prediction, but a call to action.

Six years later, the evidence is undeniable. The Level One Project and its guiding principles have not failed. They supported the building of safe, secure, reliable, efficient, and interoperable Inclusive Financial Systems. They have transformed entire economies and continue to reshape the future of financial inclusion across Africa.

Since the launch of its financial inclusion strategy in 2005, the Gates Foundation has invested more than $2 billion, working with partners across the globe to ensure that financial tools reach the people who need them most. The achievements are historic. Today, 75 percent of adults in low- and middle-income countries now own a formal financial account. The gender gap in account ownership has narrowed to just five per cent, a milestone once thought unattainable. Twenty African countries already have an Inclusive Instant Payment System in place, while another ten are developing or upgrading theirs. These are not just statistics; they are a signal of dignity, opportunity, and access for millions. Without the Gates Foundation’s leadership, particularly its Inclusive Financial Systems division, the pace of global financial inclusion would have been far slower and less coordinated.

But progress has not erased inequality. The 2025 McKinsey report “Closing the Loop: The Quest for Gender Parity in African Tech” paints a mixed picture. Africa produces the highest global share of women STEM graduates, at 47 percent, and women account for 26 percent of entrepreneurs, more than any other region. Yet less than 20 percent of top tech leadership roles are held by women, and in 2024, women-led start-ups attracted only one percent of Africa’s tech funding. The 2021 WEE-FI Barriers Analysis helps explain why. Women face obstacles at every turn. Rigid KYC requirements, lack of foundational IDs, or limited phone ownership often shut them out before they even start. High costs of mobile internet and non-transparent fee structures make access expensive. Long distances to financial service points keep many excluded. Low literacy makes it hard for many women to even start the journey. Weak consumer protection leaves them exposed and afraid to trust the system. In many homes, men are still seen as the ones to handle money, while women carry most of the unpaid work that keeps families running.

What this means is real. It means cross-border traders remain stuck in informal circles where they cannot grow. For many young women in the village, digital payments are not exciting, they are frightening. Losing even a small amount of money can shake a household, and with no one close to explain or step in when things go wrong, it feels safer to stay away. Women with ideas for businesses face another wall. They may have the drive and the vision, but raising money is close to impossible, not because the ideas lack value, but because the system was never built with them in mind.

These are not small issues. They keep millions of women from taking part in Africa’s economic growth. Traders are embroiled in cash transactions that hold them back. Rural women continue to watch opportunities pass them by. Innovators are left pushing uphill, fighting to be seen and supported. Why it matters is simple: without women, inclusion is incomplete, and without inclusion, Africa cannot achieve its promise of shared prosperity.

The good news is that solutions exist. Well-designed digital financial services have been shown to shift norms, create access, and empower women as leaders, innovators, and decision-makers. This is where the HiPipo Include Everyone Program has stepped in, working alongside the Gates Foundation’s agenda to turn policy into practice. Its focus is clear and measurable. A shift from informal to formal trading among cross-border traders. Increased use of DFS among female cross-border traders. Reduction in the gender gap in DFS use. Enhanced representation of women in leadership and policy influence.

HiPipo’s Train-the-Trainer model magnifies these outcomes. Women leaders, regulators, and community champions gain financial and digital skills, and then pass this knowledge to hundreds more in their circles. The ripple effect is fast and sustainable. When women train other women, barriers collapse faster, and progress becomes embedded in communities.

At the heart of all this is interoperability. The Level One Project Guide remains the blueprint for building systems that serve everyone, especially low-income users. Its principles of real-time, push-only, irrevocable payments, open-loop systems for banks and non-banks alike, tiered KYC, pro-poor governance, and not-for-loss utility models are now standards in the push for inclusive digital economies. As Miller Abel, Deputy Director and Principal Technologist at the Gates Foundation, put it: “A scalable, accessible, low-cost infrastructure is achievable – we have seen success in other domains. We can achieve it with real-time retail payments as well.” And as Kosta Peric reminds us: “Payments are the connective tissue of any financial system. The Level One Project Guide shows how to build and scale a real-time digital payment platform to serve low-income consumers and merchants and bring them into the formal financial economy.”

These words capture what is already happening. From Tanzania’s TIPS to the COMESA Digital Retail Payments Platform, interoperability has moved from ambition to reality. It is the infrastructure on which Africa’s digital economy is being built.

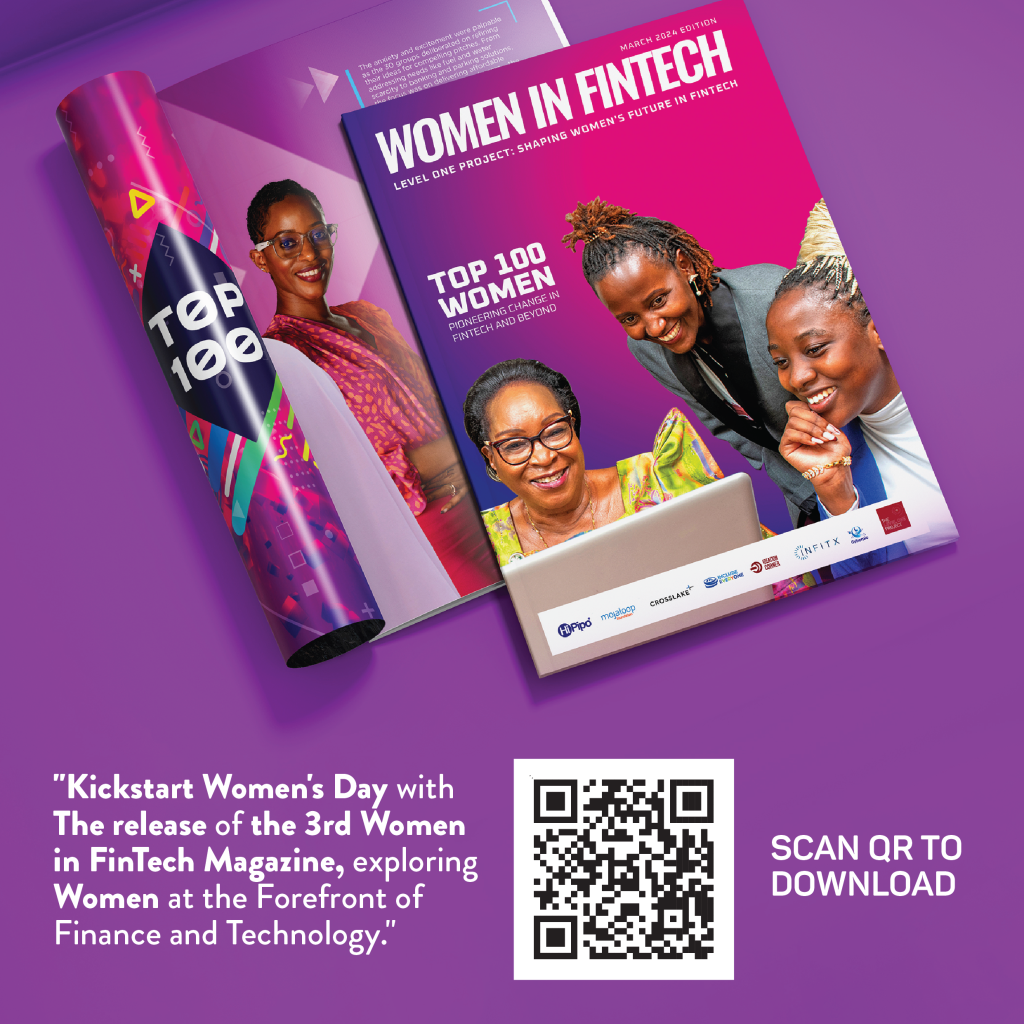

HiPipo continues to play its role in this journey. Not only as a proponent and advocate, but as a champion of inclusive design. Through initiatives like 40 Days 40 FinTechs, the Women in FinTech Hackathon, and the Digital Impact Awards Africa, HiPipo has united FinTechs, MNOs, regulators, banks, innovators and users around the cause of interoperability. These programmes have become Africa’s meeting ground for serious discussions about inclusion. HiPipo has walked the talk by ensuring that women, people with disabilities, cross-border traders, informal entrepreneurs, regulators, and policymakers are all part of the design. That is what “inclusive by design” truly means; no one left out, from the smallest trader to the biggest institution.

The danger now is complacency. Too many still see interoperability as an option rather than a necessity. That must change. When interoperability becomes mandatory, the benefits multiply. Every woman empowered with DFS strengthens her family and her community. Every cross-border trader using digital payments strengthens regional economies. Every regulator embedding inclusivity safeguards the financial future of their nation. This is why HiPipo’s advocacy is more important now than ever. By combining grassroots models like Train-the-Trainer with the Level One Project’s principles, Africa has a formula for inclusion that is both sustainable and scalable.

Africa is standing at a defining moment. The progress is real, but the gaps remain. The gender funding gap, low literacy, and stubborn social norms remind us that the job is not yet done. Yet the tools are in our hands. With the Gates Foundation’s Inclusive Financial Systems division, the Level One Project’s blueprint, HiPipo’s Include Everyone Program and several other stakeholders, we can reach the last mile. It is villages without electricity, women who trade across borders, and young people looking for a first chance that remind us why this work matters. Inclusion is not about numbers alone; it is about giving people the tools to live, trade, and dream on equal ground.

Africa has come far, but millions are still waiting. The job now is to move faster, to make digital systems work for the last person in the queue, not just those already inside the circle. That is why interoperability cannot remain optional; it must be the rule that ties us all together.

When the story of Africa’s financial journey is told, it should be clear that progress was not an accident. It was built by those who insisted that everyone counts, and that no woman, no trader, no community should be left behind.

The author is the CEO of HiPipo.