Standard Chartered Bank was yesterday announced the 2021 Digital Brand of the year. To win this Award, Standard Chartered Bank beat competition from Stanbic Bank and Centenary Bank that came second and third respectively. As such, Standard Chartered Bank retained the same prize it won in 2020.

Digital Impact Awards Africa is a platform that promotes Digital Inclusion, Financial Inclusion and Cyber security. Precisely, the Awards seek to recognize, celebrate and appreciate different individuals and organizations that are spearheading the use of digital mediums to better serve their communities.

The 8th Digital Impact Awards Africa were held on Friday, 10th December at Mestil Hotel, Kampala as part of this year’s Digital and Financial Inclusion Summit organized by HiPipo and supported by Level One Project, Mojaloop, ModusBox and Crosslake Technologies.

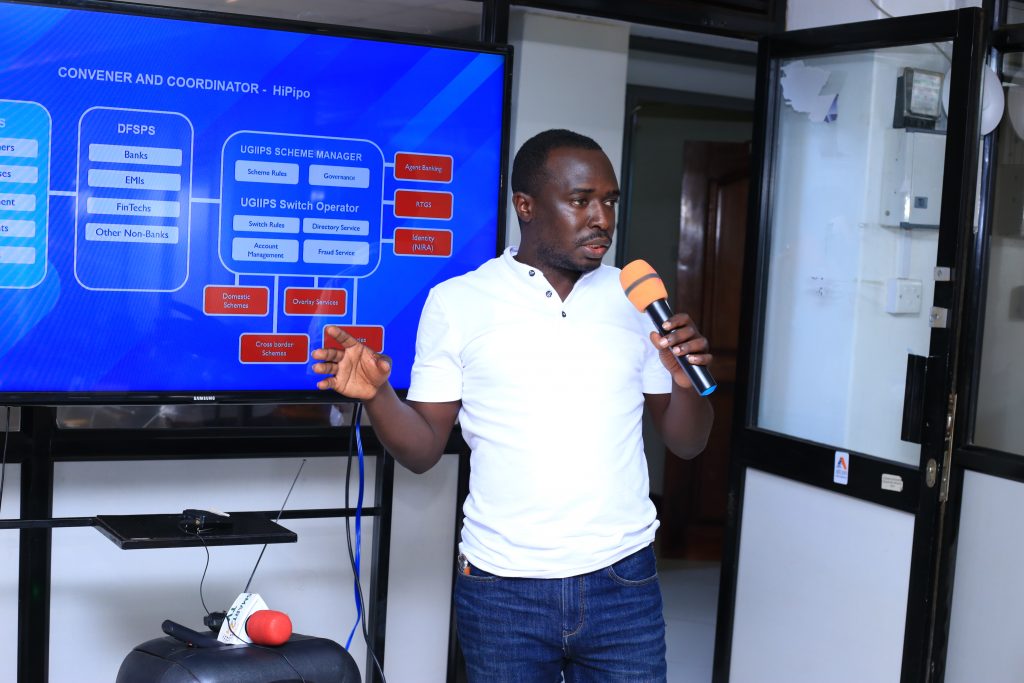

The Digital and Financial Inclusion summit explored the strategic trends and technologies that are shaping the future of Digital, Information Technology and Business with special attention to the safety of customers’ funds and security of platforms in the financial technology industry. The summit discussed at length the disruptive impact of COVID-19 on the general business ecosystem and what players must do to recover.

This year’s summit brought together C-Level executives that are spearheading the introduction, adoption and usage of digital and financial services across Africa. Speakers came from multinationals, large enterprises, small and mid-sized enterprises, start-ups, informal businesses (such as market vendors and smallholder farmers) and sole proprietorships (public transport drivers/riders and e-commerce delivery agents), among others.

Below is the full list of winners of the 2021 Digital Impact Awards Africa.

Digital Banking Excellence

- Standard Chartered Bank (Gold)

- Stanbic Bank (Silver)

Banking Innovation Excellence

- CenteOnTheGo | Centenary Bank

Community/MFI Banking Innovation Excellence

- Centenary Bank (Gold)

- Pride Microfinance (Silver)

FinTech Innovation Excellence

- Digital Ticketing for Transport Services by KaCyber Technologies. (Gold)

- SafeBoda Business Loans in partnership with Numida. (Silver)

Financial Services Digital Excellence

- Stanbic Bank (Gold)

- Standard Chartered Bank (Silver)

Consumer Goods Digital Excellence

- Movit Products (Gold)

- Café Javas (Silver)

Utilities and Government Services Digital Excellence

- NWSC (Gold)

- URA (Silver)

Technology Services Digital Excellence

- MTN Uganda (Gold)

- Rocket Health (Silver)

Digital Campaign Excellence

- Stanbic National Schools Championship (Gold)

- Jumia Anniversary (Silver)

Digital Brand of the Year

- Standard Chartered Bank (Diamond)

- Stanbic Bank (Gold)

- Centenary Bank (Silver)