Our Reporter.

While the COVID-19 crisis has taught people the importance of digital technologies in all aspects of life, its importance has been greatly felt in the financial space.

An increasing number of transactions are progressively going online as social distancing and the lockdown proved that it is only technology that can be harnessed to keep things moving, irrespective of the situation at hand.

This has played out well for Financial Technology Companies (FinTechs), which are aggressively innovating to bridge the gap.

Among them is Trade-Lance, a firm that provides integration and aggregation services to telecoms, financial institutions and utility companies, among others.

Established about 15 years ago, the financial technology company, offers a range from Value Added service solutions including project management, business audits, business analysis, systems architecture, systems development, systems integration, data centre design and management, and ICT training.

Trade-Lance is also does mobile money aggregation with MTN, Airtel, Africell and have integrations with various banks and utility companies in Uganda, according to Ewolu Nelson Mandela, the firm’s Sales and Marketing Analyst.

The firm harnesses technology to offer a range of products including micro loan support, touch pay, M-ticketing, online betting solutions, M-rent, Katale, remittances across networks, airtime to all networks, SharaPay and merchant solutions, among others.

Under micro loan support, the firm offers support for Moneylenders, donors and Saccos. The product also offers SMEs the provision to pay out loans to their customers as a well a medium for collecting premiums.

The Touch Pay product on the other hand offers a fast and secure way of paying fees, thus eliminating the need to queue in banks and sending pocket money to children at school, using mobile money. The solution also provides a closed loop student wallet system that enables parents send money to students while at school, which can be spent in areas parents are certain of.

The M-ticketing solution allows one to sell event tickets using mobile money, via a USSD code, thereby eliminating paper tickets and offering a convenient and secure way of managing events.

Trade-Lance’s Online Betting Solution enables its clients to send bets to their favourite betting companies directly from their mobile phone while the M-rent solution is used by property owners to manage their properties, collect rent and pay service providers.

This, according to Ewolu, enables one to monitor their properties’ cash flow and to plan maintenance schedules with service providers as well as paying their dues at your own convenience.

On the other hand, Katale is an online market place that offers online presence for retailers and wholesalers. It also offers international remittances in partnership with PostBank among other products.

Regional links

The firm also operates in South Sudan, where it delivered the Unified Mobile Money platform and provided a broker to the Unified mobile money platform. All third party integrations in the country use its platform. It also has presence in Ethiopia.

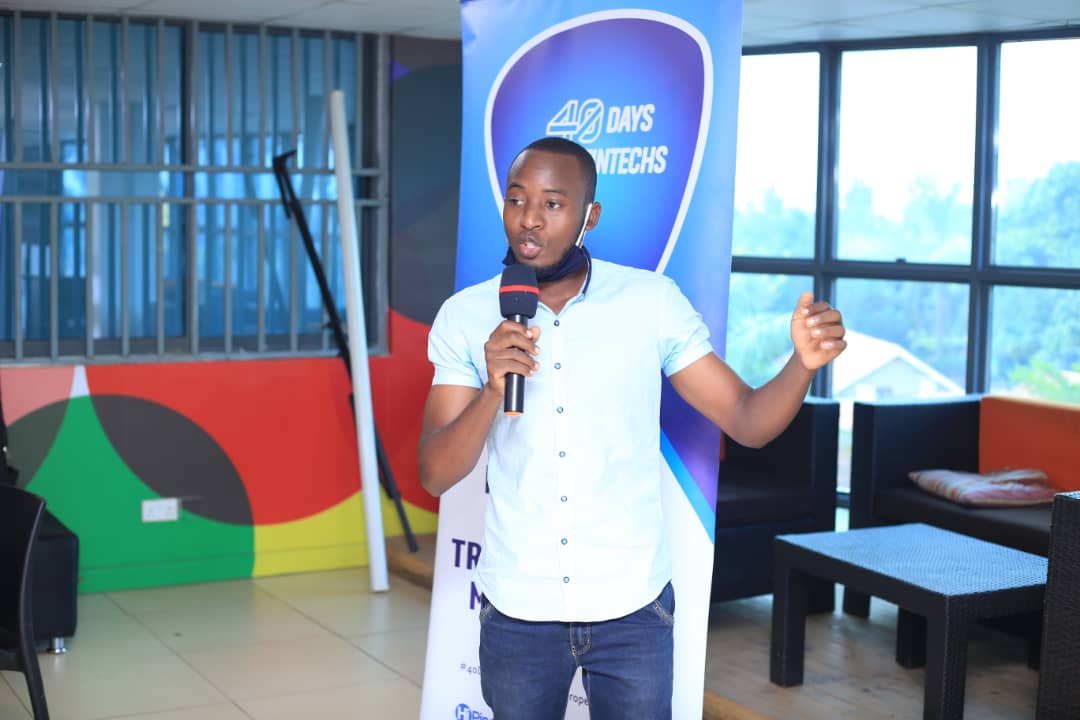

Trade-Lace is among the firms participating in the 40-days-40-FinTechs initiative organised by HiPipo, in partnership with Crosslake Tech, ModusBox and Mojaloop Foundation.

The initiative seeks to enable FinTechs to innovate solutions that facilitate cross-network financial transactions at minimal risks to enhance access to financial services.

Running for 40 days, the project will see the participating 40 FinTechs acquire interoperable development skills to improve access to financial services, using the Mojaloop open source software.

The HiPipo CEO Innocent Kawooya applauded Trade-Lance for thinking interoperability despite the existing limitations that come with connecting and integrating with the different players.

He noted that interoperability even between telecoms in Uganda is still very expensive.

“For every single transaction, you are charged a minimum of 13%, which is very high for finance,” Kawooya said.

He added: “So the 40-days-40-FinTechs initiative is part of our 15- year journey of advocating for digital transformation.”

In organizing the 40-days-40-FinTechs project, Kawooya said that HiPipo wants to use the knowledge and skills acquired from its association with some of the founders of new edge technology – Microsoft, Google, Linux and Facebook – to create a leveled ground that allows everyone to play in the same playing field.

He said that working collaboratively will promote innovation and in turn boost financial inclusion.

Kawooya noted that COVID-19 has also shown people that this is the time for everyone to think digital.

He further noted that anyone who innovate around mobile in Africa is destined to succeed, given that Africa is an economy, which people refer to as a mobile first continent.

“It has been proved that all those who innovate around the mobile easily get to capture the market and easily get to grow and to sustainably serve and transform lives,” Kawooya said.

Kawooya said that HiPipo seeks to ensure that the world, starting from Africa, achieves full digital transformation, given the enormous opportunities that come with digital exposure.