YEPI YEPI YOOH.

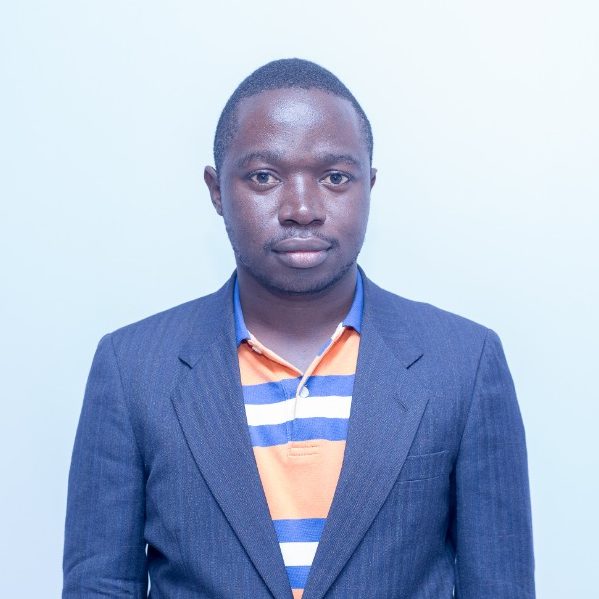

This is Nicholas Ntulume Luyimbula. Many know me as DJ Nick – a radio host and deejay.

Well today, I am not playing your favourite music.

Instead, I am here to share with you an ANTIDOTE that will keep all of us SAFE.

This is a call for you to embrace digital financial services. I mean, now than ever before, we should all be doing digital transactions. Receive your payments through your bank account or mobile money and transact electronically.

Encourage your Rolex (eggs in chapatti) guy to accept mobile payments. Advise your market lady to get a pay bill number. Teach your laundry person the advantages of transacting electronically.

This is a digital era and no one should be left behind.

We must include everyone because AN ECONOMY THAT INCLUDES EVERYONE BENEFITS EVERYONE.

Allow me thank the HiPipo Foundation for spearheading this Digital-Financial Inclusion awareness drive.

Wash your hands, sanitize, social distance, stay home and transact electronically.

STAY SAFE UGANDA.